Philips' Second Quarter and Semi-Annual Results 2014

Philips reports Q2 sales of EUR 5.3 billion and EBITA of EUR 415 million

July 21, 2014

“In the second quarter we continued to face headwinds, including ongoing softness in certain markets, unfavorable currency exchange rates and the voluntary suspension of production at our health care facility in Cleveland. At the same time, we are taking decisive action to accelerate value creation, improve performance and capitalize on higher growth opportunities in our businesses. This is demonstrated by our announcement to create a stand-alone company within Philips for the combined Lumileds (LED components) and Automotive lighting businesses and the implementation of the new management structure in Healthcare. While 2014 is expected to be a challenging year overall, we anticipate EBITA for the Group, excluding restructuring and acquisition-related charges and other items, in the second half of the year to exceed the level of the same period last year. We continue to increase efficiency and drive profitable growth through the execution of our multi-year Accelerate! transformation and are firmly committed to reaching our 2016 targets.” Q2 financial and operational overview: “In the second quarter, we continued to see results of our focus to win large-scale multi-year partnerships – such as the recently announced agreement with New Karolinska Hospital in Solna, Sweden – designed to structurally improve patient care at lower and more predictable costs. Further, our strategic alliance with salesforce.com on a new cloud-based health care IT platform demonstrates our holistic innovation approach to health care, enabling us to rapidly launch new clinical applications for home care and care coordination. Our recently announced new management structure will further drive operational excellence and agility to restore performance over the next several quarters. While the voluntary temporary suspension of production at our Cleveland facility continued to impact our performance this quarter, our corrective actions are progressing according to plan and shipments are expected to resume gradually in the course of Q3 2014. In light of this and the recent strong equipment order intake in China and Europe, we expect the performance improvement in the second half of the year to be back-end loaded.” Healthcare comparable sales showed a 4% decline year-on-year. The EBITA margin, excluding restructuring and acquisition-related charges, declined to 10.5%, a decrease of 3.8 percentage points year-on-year. Equipment order Q2 2014 Quarterly report and Semi-annual report intake in Europe and growth geographies showed a high-single-digit increase, while North America posted a double-digit decline. “In Consumer Lifestyle, we have implemented a strategic shift to leverage our strengths in the growing area of personal health and well-being, which is empowering millions of consumers to make healthier choices every day. This has resulted in more than 10 consecutive quarters of strong comparable sales growth. With the sale of WOOX Innovations completed at the end of June, Consumer Lifestyle is now fully focused on realizing the great potential in its portfolio by offering locally relevant products while leveraging its global scale.” Consumer Lifestyle comparable sales increased by 7%, with above-average sector growth coming from Health & Wellness and Domestic Appliances. Sales in Personal Care were flat due to market dynamics in China and North America. In growth geographies, comparable sales showed double-digit growth, while mature geographies achieved low-single-digit growth. The EBITA margin, excluding restructuring and acquisition-related charges and other items, increased to 9.4%, a year-on-year improvement of 1.6 percentage points. Philips Consumer Lifestyle has rationalized its portfolio to focus on personal health and well-being. Accordingly, Philips is expanding its market reach, building the Philips brand in business adjacencies such as the beauty and air categories and expanding its geographic distribution in China, Philips’ second-largest market. Moreover, Philips is capturing the digital opportunity by growing its online presence and developing its connected products portfolio. “In Lighting, we are intensifying our focus on connected LED lighting systems and services, LED luminaires, and LED lamps for the professional and consumer markets. Our decision to combine the Lumileds and Automotive lighting businesses into a stand-alone company within Philips will allow it to extend its leading portfolio of digital lighting components and achieve robust growth, serving even more customers in the industry, as well as Philips Lighting. Lighting is taking advantage of the many opportunities in the growing LED space, driven by increased demand for energy efficiency and digital controls. We are also making good progress in Professional Lighting Solutions North America, and we anticipate improvement in Q3 and a return to profitability in the second half of the year.” Philips is taking actions to improve profitability in its Lighting business while also accelerating the drive to LED. The Company’s strong and continuous focus on optimizing its manufacturing footprint and the overall cost base has resulted in the 8th consecutive quarter of year-on-year improved operational profitability. The recovery in Consumer Luminaires in Europe is progressing, and the Company aims to make this business break-even for the full year. In the second quarter, we continued to see strong momentum in LED-based sales, which grew 43% and now represent 36% of total Lighting sales. At the same time, we saw a 13% decline in our conventional lighting sales in the quarter. The Company is therefore accelerating actions to ensure the continued profitability of conventional lighting over the coming years and plans to pull forward the ongoing industrial footprint rationalization program for the Lighting sector, raising charges in the second half of 2014 from EUR 100 million to approximately EUR 170 million. Innovation, Group & Services “The favorable performance in IG&S, supported by increased royalties from intellectual property, is the result of our continued investments in industry-leading technology platforms and innovative research and development.” Excluding restructuring charges and past-service pension cost gains, EBITA was a net cost of EUR 44 million, compared to a net cost of EUR 60 million in Q2 2013. The improvement was mainly due to lower costs in the IT Service Units and higher IP royalties, partly offset by higher investments by Group Innovation in emerging business areas. Update on Accelerate! program: We continue to execute on our multi-year transformation program Accelerate!, as we are strengthening our innovation pipeline through our focus on reducing time to market, increasing local relevance, improving quality, and better prioritization of investments. Moreover, the Company continued to make good progress on its three cost savings programs in the second quarter. The overhead cost savings were EUR 34 million for the quarter, bringing the cumulative annualized overhead cost savings in the first half of the year to EUR 190 million. The Design for Excellence (DfX) program generated EUR 44 million of incremental savings in the bill of material in the quarter, and the End-to-End productivity program generated EUR 5 million of savings. With these actions, we are continuing to deliver on our promise to improve operational and financial performance company-wide, as we transform Philips into a leading technology company in health and well-being. As of June 30, 2014, Philips had completed 26% of the EUR 1.5 billion share buy-back program. Quarterly Report Presentation Conference call and audio webcast

Frans van Houten, CEO, and Ron Wirahadiraksa, CFO, will host a conference call for investors and analysts at 10:00 am CET to discuss the results. A live audio webcast of the conference call will be available through the link below.

More information about Frans van Houten and Ron Wirahadiraksa

Philips' Second Quarter and Semi-Annual Results 2014 Infographic

Philips and Salesforce.com announced a strategic alliance

Driving industry transformation in collaborative care, Philips and salesforce.com announced an alliance to deliver a cloud-based healthcare platform. The platform leverages Philips’ leadership in medical

Driving industry transformation in collaborative care, Philips and salesforce.com announced an alliance to deliver a cloud-based healthcare platform. The platform leverages Philips’ leadership in medical

technology, clinical applications and clinical informatics, to enhance clinical decision making and enable patients to manage their personal health.

Philips introduced VISIQ in Africa and India

Advancing affordable, high-quality diagnostic imaging worldwide, Philips introduced VISIQ, its first

Advancing affordable, high-quality diagnostic imaging worldwide, Philips introduced VISIQ, its first

ultra-mobile ultrasound system, in Africa and India. Featuring a tablet-and-transducer design, VISIQ makes ultrasound available for patients in a wide range of environments.

Philips introduced Philips VisaCare and Philips VisaPure Men

Delivering on its strategy to build the Philips brand in the beauty category, Philips introduced Philips

Delivering on its strategy to build the Philips brand in the beauty category, Philips introduced Philips

VisaCare and Philips VisaPure Men. The latter is a device specifically designed for male skin cleansing, which is a rapidly growing segment driven by Asian markets such as Korea.

Philips becomes official lighting partner for FC Bayern Munich and its home stadium

Philips became the official lighting partner of the Allianz Arena, home to FC Bayern Munich. The Arena

Philips became the official lighting partner of the Allianz Arena, home to FC Bayern Munich. The Arena

will be the largest stadium in Europe to feature a connected LED lighting system which will turn the

façade into a dynamic colored light display.

Philips brings dazzling LED lights to the new shopping entertainment mall VEGAS Crocus City in Moscow

Driving innovation in professional systems and services, Philips is lighting the media façade of

Driving innovation in professional systems and services, Philips is lighting the media façade of

Moscow’s VEGAS Crocus City shopping entertainment mall. This represents Philips’ largest

project realized using connected architectural lighting technology.

Philips cited a top riser in sustainability ranking by Interbrand’s Best Global Green Brands

Highlighting Philips’ commitment to Green Innovation, Philips was the fastest-rising technology brand in Interbrand’s annual ranking of the top 50 Best Global Green Brands. Advancing nine places, Philips now holds the 14th position.

Highlighting Philips’ commitment to Green Innovation, Philips was the fastest-rising technology brand in Interbrand’s annual ranking of the top 50 Best Global Green Brands. Advancing nine places, Philips now holds the 14th position.

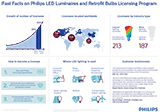

Philips LED Luminaires and Retrofit Bulbs Licensing Program reaches 400th licensee milestone

Philips welcomed the 400th licensee to its LED Luminaires and Retrofit Bulbs Licensing Program, an increase of 100 licensees since May last year. With this program, Philips is fostering LED industry growth by offering companies access to its wide portfolio of patented LED system technologies and solutions.

Philips welcomed the 400th licensee to its LED Luminaires and Retrofit Bulbs Licensing Program, an increase of 100 licensees since May last year. With this program, Philips is fostering LED industry growth by offering companies access to its wide portfolio of patented LED system technologies and solutions.

For further information, please contact:

Joost Akkermans

Philips Group Communications

Tel: +31 20 59 78049

Email: joost.akkermans@philips.com

Steve Klink

Philips Group Communications

Tel.: +31 6 10888824

E-mail: steve.klink@philips.com

About Royal Philips:

Royal Philips (NYSE: PHG, AEX: PHIA) is a diversified health and well-being company, focused on improving people’s lives through meaningful innovation in the areas of Healthcare, Consumer Lifestyle and Lighting. Headquartered in the Netherlands, Philips posted 2013 sales of EUR 23.3 billion and employs approximately 113,000 employees with sales and services in more than 100 countries. The company is a leader in cardiac care, acute care and home healthcare, energy efficient lighting solutions and new lighting applications, as well as male shaving and grooming and oral healthcare. News from Philips is located at www.philips.com/newscenter.

Forward-looking statements

This document and the related oral presentation, including responses to questions following the presentation, contain certain forward-looking statements with respect to the financial condition, results of operations and business of Philips and certain of the plans and objectives of Philips with respect to these items. Examples of forward-looking statements include statements made about the strategy, estimates of sales growth, future EBITA and future developments in Philips’ organic business. By their nature, these statements involve risk and uncertainty because they relate to future events and circumstances and there are many factors that could cause actual results and developments to differ materially from those expressed or implied by these statements. These factors include but are not limited to domestic and global economic and business conditions, developments within the euro zone, the successful implementation of Philips’ strategy and the ability to realize the benefits of this strategy, the ability to develop and market new products, changes in legislation, legal claims, changes in exchange and interest rates, changes in tax rates, pension costs and actuarial assumptions, raw materials and employee costs, the ability to identify and complete successful acquisitions and to integrate those acquisitions into the business, the ability to successfully exit certain businesses or restructure operations, the rate of technological changes, political, economic and other developments in countries where Philips operates, industry consolidation and competition. As a result, Philips’ actual future results may differ materially from the plans, goals and expectations set forth in such forward-looking statements. For a discussion of factors that could cause future results to differ from such forward-looking statements, see the Risk management chapter included in the Annual Report 2013. Third-party market share data Statements regarding market share, including those regarding Philips’ competitive position, contained in this document are based on outside sources such as research institutes, industry and dealer panels in combination with management estimates. Where information is not yet available to Philips, those statements may also be based on estimates and projections prepared by outside sources or management. Rankings are based on sales unless otherwise stated. Use of non-GAAP information In presenting and discussing the Philips financial position, operating results and cash flows, management uses certain non-GAAP financial measures. These non-GAAP financial measures should not be viewed in isolation as alternatives to the equivalent IFRS measures and should be used in conjunction with the most directly comparable IFRS measures. A reconciliation of these non-GAAP measures to the most directly comparable IFRS measures is contained in this document. Further information on non-GAAP measures can be found in the Annual Report 2013. Use of fair-value measurements In presenting the Philips financial position, fair values are used for the measurement of various items in accordance with the applicable accounting standards. These fair values are based on market prices, where available, and are obtained from sources that are deemed to be reliable. Readers are cautioned that these values are subject to changes over time and are only valid at the balance sheet date. When quoted prices or observable market data are not readily available, fair values are estimated using appropriate valuation models and unobservable inputs. Such fair value estimates require management to make significant assumptions with respect to future developments, which are inherently uncertain and may therefore deviate from actual developments. Critical assumptions used are disclosed in the Annual Report 2013. Independent valuations may have been obtained to support management’s determination of fair values. All amounts are in millions of euros unless otherwise stated. All reported data is unaudited. This interim financial report is prepared in accordance with IAS 34 Interim Financial Reporting as adopted by the European Union and the accounting policies are the same as stated in the Annual Report 2013, unless otherwise stated. Prior-period financial statements have been restated to reflect two voluntary accounting policy changes and a change in the divestment of the AVM&A business. For more details see note 1, Significant accounting policies, section Other changes. An overview of the revised 2012 full year and 2013 figures per quarter is available on the Philips website, in the Investor Relations section.